Dear Readers,

The early pioneers set the stage for what’s to come. While the early products don’t often succeed to their promised potential, they are nevertheless necessary to pave the way for the successes that follow in a field. In CAR-T, Novartis once it had recognised its potential led efforts that ushered in a commercial rush in the field starting 2012. The field remains green despite almost a decade of science behind it.

Optimistic people play a disproportionate role in shaping our lives. Their decisions make a difference; they are inventors, entrepreneurs, political and military leaders - not average people. They got to where they are by seeking challenges and taking risks—Daniel Kahneman.

Current landscape of active CAR-T trials

Now, there are more than 1000 CAR-T cell trials being conducted worldwide. This abundance of trials leaves us paralysed in making correct decision in where to focus our energies for investing in this space. However, decision making becomes easier when we are empowered with right information. Check Part 1 and Part 2 of CAR-T series to understand the science behind this breakthrough therapy. In this article, we will dive into the translational and commercial world of CAR-T therapy.

All of us would be better investors if we just made fewer decisions—Daniel Kahneman.

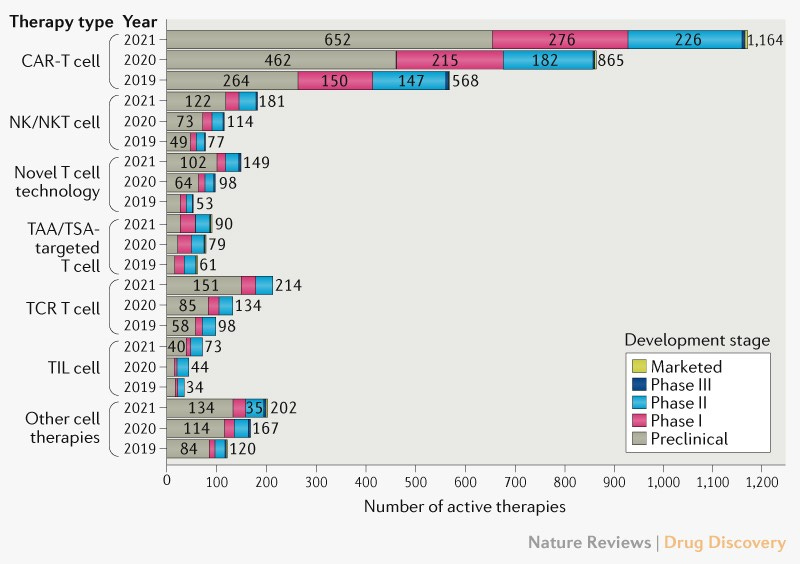

Among the different cancer cell therapies, CAR-T has the largest increase in the number of agents as compared to 2019. There is also increase in novel T cell approaches (such as CRISPR engineered T cells or γδT cells) and other cell therapies (such as NK, NKT and Macrophage-based therapy).

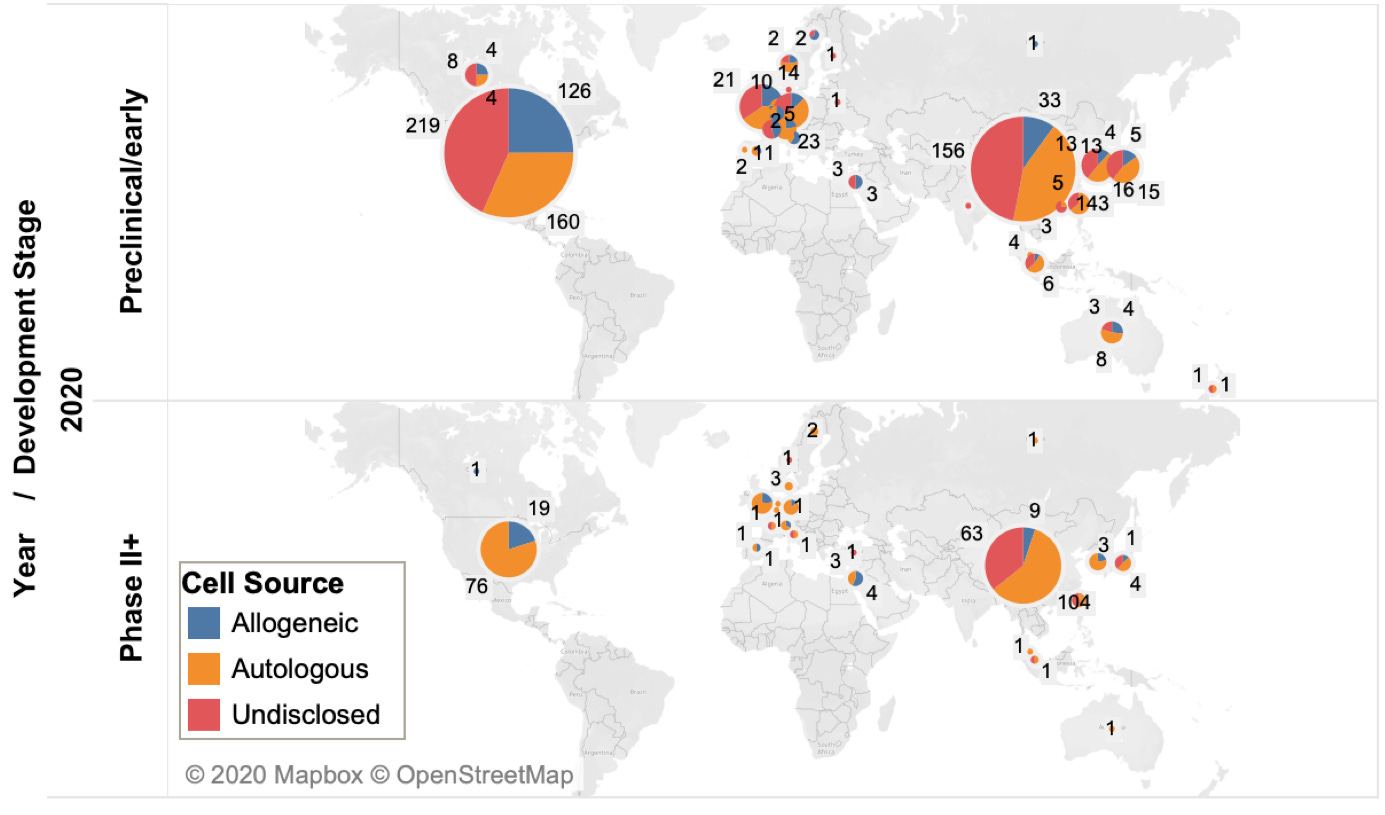

To understand the trend of clinical trials, the active CAR-T agents are further reclassified based on their origin as autologous or allogeneic (off-the-shelf) and their development phases. Some of these agents’ origin has not been disclosed (majorly being developed in countries other than the US).

The United States and China dominate the cancer cell therapy pipeline. However, currently, China has more cell therapy trials (871) than the United States (718).

Click on the link, if interested to read in detail about Clinical development of CAR T cell therapy in China: 2020 update

Real world data for Approved CAR-T

The real world utilisation of approved CAR-T therapies mimics the experience that had been previously seen in clinical trials. Also there were no new emerging toxicity signals in real life.

It gives clinicians more confidence to provide this treatment to patients outside the confines of a clinical trial—Michael D. Jain, MD, PhD

However, of note, the previously marketed Zalmoxis (Nalotimagene carmaleucel) was withdrawn from the European Union (EU) markets by its manufacturer MolMed SpA in October 2019 following its failure to improve disease-free survival in a phase III trial. Zalmoxis, consists of allogeneic T-cells genetically modified with a retroviral vector encoding for the human low-affinity nerve growth factor receptor and the herpes simplex I virus thymidine kinase. In 2016, it was designated an orphan medicinal product and granted a conditional marketing authorisation by EMA.

Let’s now unravel the pioneer CAR-T companies:

CAR-T Pioneers

Novartis, Gilead, and Bristol-Myers Squibb are the leaders of the first generation of cancer cell therapies.

All the approved CAR-T agents of these companies are against CD19, a marker of B cells and all have the same first gas pedal (co-stimulatory domain), CD3. However, each contains small esoteric differences, they differ in the second signal — the second ‘gas pedal’ that turns on the CAR T cells. Kymriah® (Novartis) and Breyanzi® (BMS) have 4-1BB second signal and Yescarta® and Tecartus® (Gilead) have CD28 second signal. It’s difficult to say which CAR-T therapy is superior as no head-to-head comparative-effectiveness clinical trials have been conducted. However, neurotoxicity rates appear to be similar among all CAR T-cell therapies approved.

In addition to the approved therapies, these companies have clinically advanced pipeline designed for different targets of haematological cancers. Below chart highlights the top targets of cell therapies for blood cancers currently in clinical trials:

CD19 is still the most dominant target for blood cancers. However, one efficacy issue with anti-CD19 CAR-Ts is that they effectively select for cancer cells that are invisible to the therapies which results into most patients relapsing after treatment with CD19-negative disease. Tumors escape from therapy by losing the antigen that CAR-T cells are targeting. This happens at such high frequency that now new additional antigens are identified along with CD19 (bispecific CAR-T cell). Biotech companies including Autolus Therapeutics (NASDAQ: AUTL) and Gracell Biotechnologies (NASDAQ: GRCL) are developing bi-specific CAR-T therapies (will be discussed in detail in Part-4). Above graph shows that the number of active agents targeting B cell maturation antigen (BCMA) or CD22 have nearly doubled since last year.

CAR-T therapy targeting BCMA developed by Legend Biotech in Nanjing, China demonstrated 69% CRR (complete response rate) in heavily pre-treated multiple myeloma patients. For the rights of this therapy, J&J paid USD 350 million upfront in 2017.

Another problem with the first generation cell therapy is persistence in blood, long-term follow up studies identified that CAR-Ts persisted for 13–87 days in the circulation. Pioneer companies and other innovator companies (such as Kuur Therapeutics, etc: will be discussed in detail in Part-4) are improving CAR-T engineering techniques to increase the persistence of T cells in patients circulation. This will increase the efficiency of CAR-T cells to nip the cancer in the bud and reduce the chances of recurrence/relapse.

The current FDA-approved products are for third-line therapy, that means it can be given only to patients with decent EGOG performance status (it is a scale used to assess how a patient's disease is progressing), after having failed at least two prior standard cancer therapies.

The pioneer companies are now pushing to simplify the logistics of cell therapy production alongside efforts are being made to improve the efficacy of first-generation products. These companies are also testing the approved CAR-T as second line therapy for patients with B cell malignancies. Let’s see what additional steps these companies have made after they received FDA approval for CAR-T:

1. Novartis (NYSE: NVX)

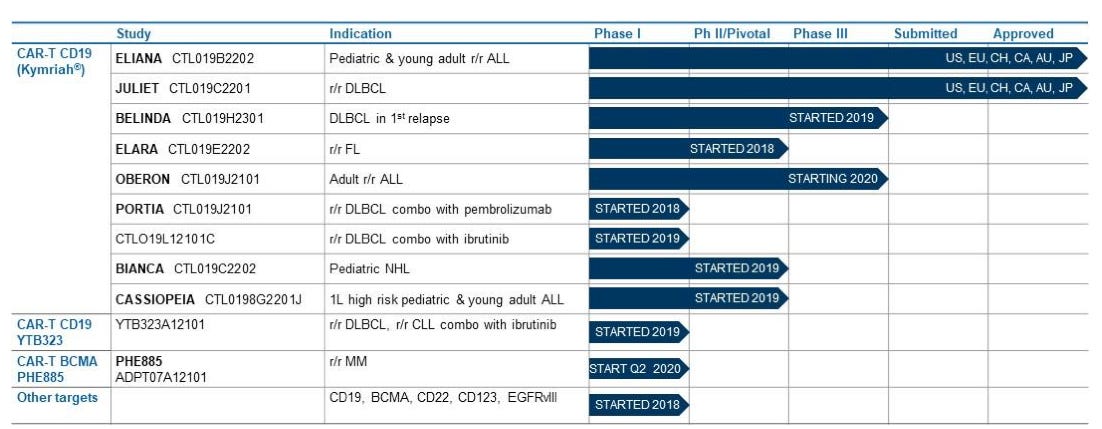

A global leader in integrated cancer solutions, received approval of the first CAR-T cell therapy, Kymriah® in 2017. It consists of autologous T-cells genetically modified using a lentiviral vector to encode an anti-CD19 CAR. Kymriah® is now available in more than 25 countries for refractory or relapsed (r/r) pediatric and adult patients with B-cell ALL and also for r/r large B-cell lymphoma in adult patients.

The company is now strongly focusing on AAV-based therapies, CAR-T cell therapies and CRISPR-based technologies for research and development of potentially transformative cell and gene therapies.

Novartis currently has CAR-T cell therapy manufacturing facilities in the USA, Switzerland and France. In addition, Novartis has third-party agreements with manufacturers in Germany, Japan, and China to produce CAR-T cell therapies.

In the USA, Novartis aims to manufacture Kymriah in 22 days through traditional approach, however now they are advancing the manufacturing process by improving and accelerating the whole process with Activated Rapid Manufacturing (ARM). First CAR-T using ARM platform, YTB323 is under Phase 1 trial.

To increase the persistence of CAR-T cells in blood circulation Novartis partnered with Poseida Therapeutics (NASDAQ: PSTX), which received a USD 75 million investment from Novartis in April 2019. They are using a high percentage of less-differentiated T cells to resolve this issue.

The price tag of Kymriah® is quite high and remains at USD 475,000, hopefully ARM will help to reduce the price, enabling more patients to access the treatments.

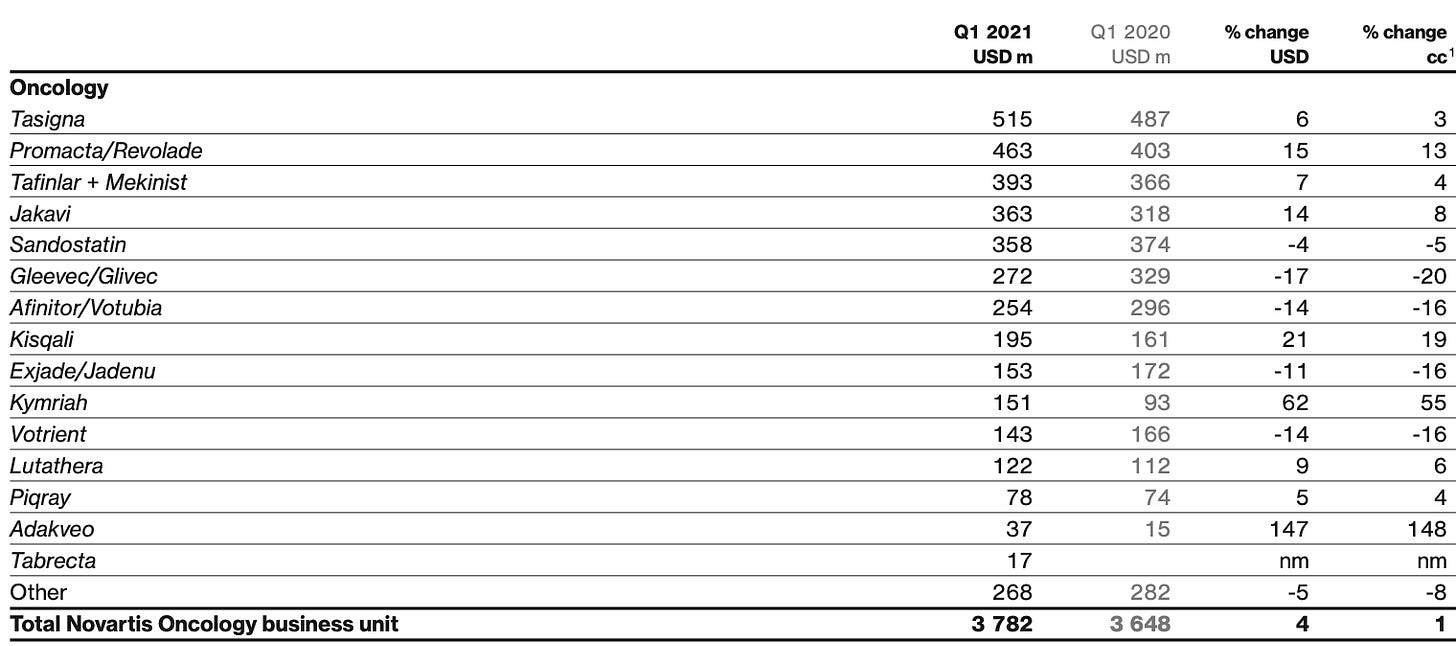

Kymriah has seen some sales pickup recently albeit well below the promised potential. In 1Q2021, it sold USD 151m (+55% y/y cc) worldwide. Coverage continued to expand, with more than 300 qualified treatment centers in 28 countries having coverage for at least one indication.

**Oxford BioMedica plc signed an agreement with Novartis for the commercial and clinical supply of lentiviral vectors used to generate CTL019 (tisagenlecleucel) and other undisclosed Chimeric Antigen Receptor T cell (CART) products.

2. Gilead Sciences (NASDAQ: GILD)

Gilead subsidiary Kite Pharma (Gilead acquired Kite Pharma in 2017), developed the firm's CAR T-cell programs. It has dominance in CAR-T sector with its autologous cell therapy (eACT™) platform. To further accelerate the development of next generation cellular therapy candidates, Gilead also acquired Cell Design Labs in 2017. Gilead is one of the best capitalised and most aggressive players in the CAR-T space.

Cell Design Labs is a biotherapeutics company, it brought with them synNotch (a synthetic gene expression system that responds to external cues) and Throttle (an on switch that modulates CAR T activity using small molecules) technology platforms to expand the cell therapy toolbox.

Since January 2015, Amgen (NASDAQ: AMGN) and Kite Pharma have strategic alliance which combines Amgen's immuno-oncology targets and Kite's leading CAR-T cell therapy platform to develop new therapeutic candidates.

Gilead received FDA approval for the CAR-T cell therapy, Yescarta® (Axicabtagene ciloleucelin) in Oct, 2017 for the treatment of adult patients with r/r large B cell lymphoma after two or more lines of systemic therapy, including patients with DLBCL not otherwise specified, primary mediastinal large B cell lymphoma, high-grade B cell lymphoma, and DLBCL arising from follicular lymphoma. Yescarta® is a CD19-directed autologous T-cell immunotherapy genetically modified using a retroviral vector. The price tag of Yescarta® is quite high USD 373,000 and it’s important to see how the company plans to bring the price down.

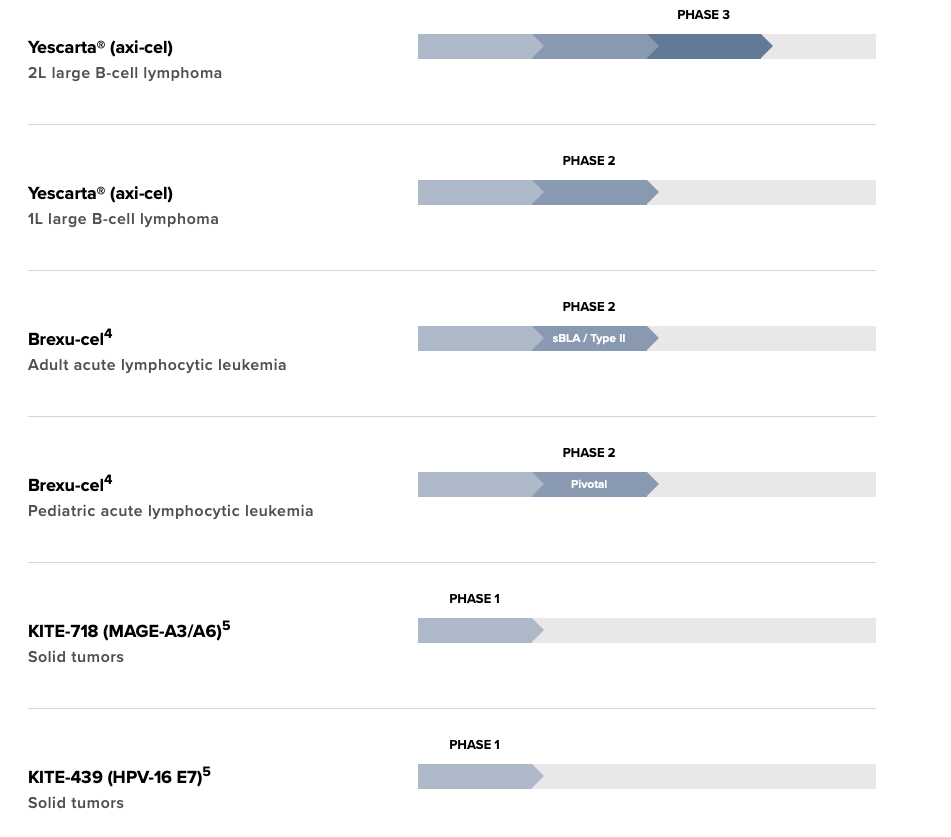

Yescarta is being evaluated as second-line therapy for relapsed or refractory large B-cell lymphoma (ZUMA-7 trial).

Another CAR-T therapy, Tecartus (Brexucabtagene autoleucel) developed by Gilead subsidiary Kite Pharma was approved for medical use in the United States in July 2020, and in the European Union in December 2020 for r/r Mantle Cell Lymphoma. Approval was based on ZUMA-2 (NCT02601313), patients treated with Tecartus showed 62% complete remission rate and an objective response rate of 87%. Tecartus is anti-CD19 CAR-T therapy like Yescarta, however unlike the latter Tecartus uses technology that includes T-cell selection and lymphocyte enrichment (necessary in B-cell malignancies such as mantle cell in which there are circulating lymphoblasts in the peripheral blood). Tecartus list price is USD 373,000 for single dose infusion.

Gilead’s now positioning its newer CAR-T drug Tecartus for adult acute lymphoblastic leukemia (ALL). Phase 2 clinical trials (ZUMA-3 trial) data looks promising, according to data unveiled at the American Society of Clinical Oncology annual meeting.

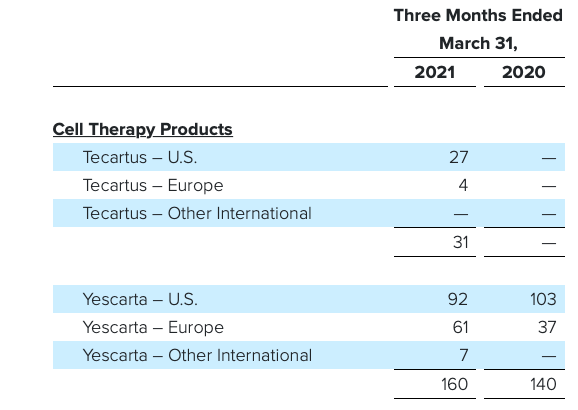

In the first quarter of FY2021, the older Yescarta brought in sales of USD 160 million up only modestly y/y while Tecartus hauled in USD 31 million.

2021 is a catalyst-heavy year for Gilead, as we've delivered all of our key first-half pipeline commitments. The business is diversifying across indications and therapies, and in particular, we're seeing cell therapy and Trodelvy contribute to growth. We expect they will be key growth drivers for Gilead— Daniel O'Day (CEO, Gilead)

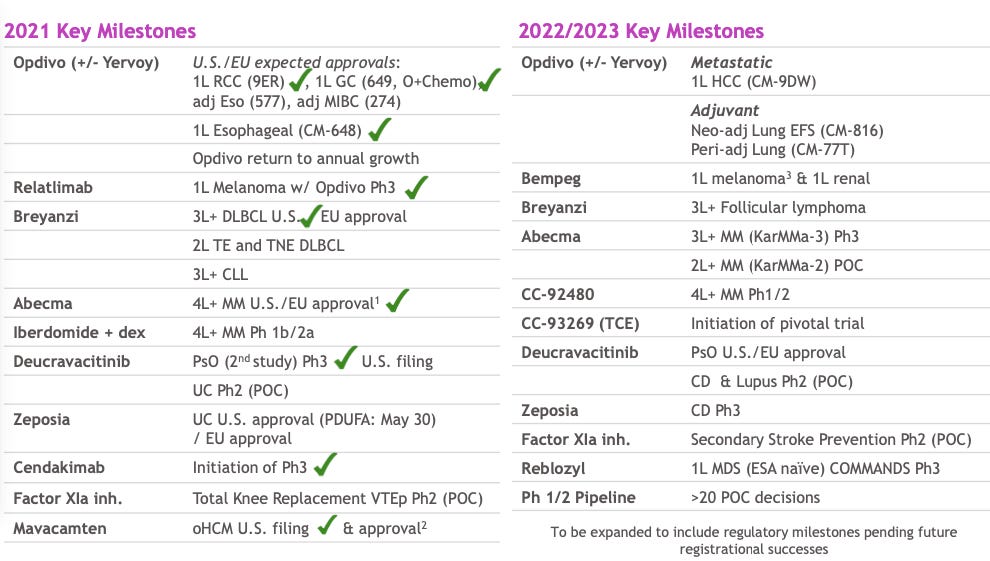

3. Bristol-Myers Squibb Company (NYSE:BMY)

With the integration of Celgene Corporation (NASDAQ:CELG) and with it, Juno Therapeutics, a pioneer in the development of CAR-T and TCR-T cell therapeutics – cell therapy research has been a core pillar of Bristol Myers Squibb’s cancer research efforts.

Additionally, Celgene entered a USD 200 million deal with Agios pharmaceuticals (NASDAQ: AGIO) to develop therapeutics that impact cellular metabolism and explore immuno-oncology drug prospects.

BMY has a diverse pipeline of early- and late-stage CAR T therapies in blood cancers, including multiple myeloma, lymphoma and leukemia.

Breyanzi (Lisocabtagene maraleucel) developed by Juno Therapeutics (now acquired by BMS) got FDA approval for refractory B cell lymphomas in 2021. Clinical Trial identifier: NCT02030834 data demonstrated 64% objective response and 43% patients showed complete remission. Analysts expect Breyanzi to have peak sales of USD 1 billion.

The TRANSFORM study is now evaluating Breyanzi as second-line therapy for the same indication and other studies are also in the works.

BMS is investing in the future of cell therapy in myriad ways, including

Engineering next-generation approaches to tackle the numerous challenges of solid tumors, such as engineering TCR modified T cells for solid tumors, which can recognize tumor-specific proteins normally found on the inside of cells; Dual antigen (dual CARs or carpool) targeting CAR T approaches; CAR T cells armed with tunable, or custom payloads

Advancing its proprietary NEX-T manufacturing platform and

Allogenic CARs, “off-the-shelf” approaches.

These advancements will help to reduce the turnaround time and costs while increasing product quality and control.

Through machine learning and other sophisticated approaches, we’re using data to deliver critical insights that inform and optimize patient selection, process improvements, as well as engineering and combination approaches to address resistance mechanisms – and these insights are all the more valuable given that our datasets are derived from multiple indications and manufacturing processes.—Teri Foy (BMS)

The pioneers are facing growing competition from a sea of startups, innovator companies and other, deal-hungry biopharma companies in the race to better the efficacy of Yescarta and Kymriah in blood cancers, expand the use of cell therapies to new indications, including solid tumors, and simplify logistics and manufacturing.

In the next article (Part 4), we will unravel the innovator companies. Stay tuned!